Let me try to answer the age old question… “How is the real estate market on Anna Maria Island?” This as anyone can imagine is a difficult question to answer. This newsletter is meant to provide general real estate information about Anna Maria Island real estate but for sure there are several micro markets within Anna Maria Island real estate. Not to bore you but below is a bullet list of our micro real estate markets.

- Which city is the property in? Anna Maria, Holmes Beach or Bradenton Beach?

- Does the property have favorable rentability? That is if duration and/or frequency is limited for vacation guests.

- What is the location of the property as it relates to water? Is the property gulf front, gulf views, canal, bay, open water and the list goes on and on.

- Is the property a single family, condo or duplex?

As you can see it is dangerous to attempt to purchase property without a local full time real estate professional. I can’t tell you how many proud new owners of property on Anna Maria Island called to receive help renting out their property and I was the bearer of bad news. Either the location was too far from the beach or worse yet the property was restricted to 30 consecutive day rentals. Normally when I asked who helped them purchase their property it was a relative from another area or a real estate professional in Sarasota or Tampa. Please, dont do it!

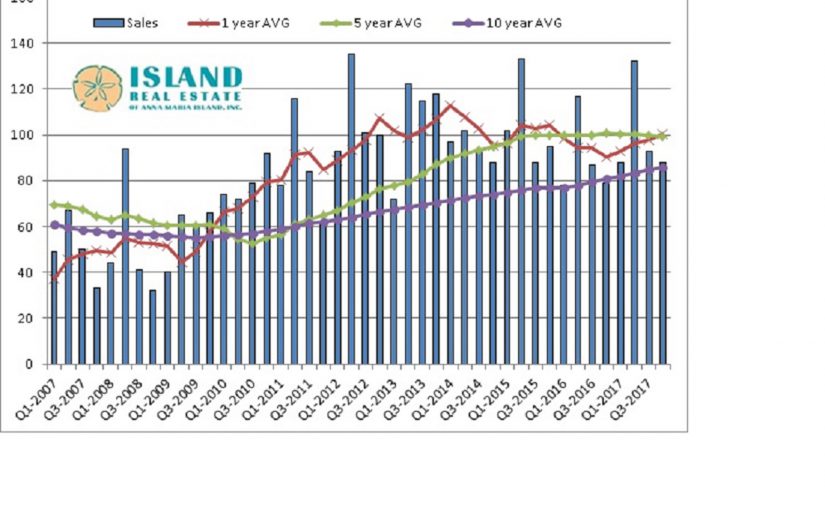

At the top of the page is a proprietary chart that supplies more than 10 years of real estate data on Anna Maria Island only. The blue vertical bars show by quarter the amount of real estate transactions. The Red line shows the 1 year rolling average of property transactions. The Green line shows the 5 year rolling average and the purple line shows the 10 year moving average.

Why am I showing you this chart? This can be used to forecast when the market is getting close to a correction. I usually like to use the 5 year moving average however some prefer the 10 year as the benchmark. If you review the last year and half you can see the 5 year rolling average has leveled. Most statisticians would also point to the areas where the 1 year rolling average dips below the 5 year average and of course points to a general trend of values going down on the island. BUT, not so quick. This is where micro markets are affecting the rolling averages. Single family properties within 3 blocks to the beach have been appreciating very well while condos have not and have been flat at best for the last two years. How muddy did I just make the water? I hope pretty muddy and believe it or not my main point is that the answer of “how is the real estate market?” depends on AT LEAST the bullets I listed above. Ask specifically about single family homes and my answer is “very well”, averaging double digit appreciation the last 5 years. Ask about condos and my answer would be “not great.” Inflationary appreciation for the most part and the real question is when will condos catch up to single family homes? Sorry, don’t have that answer. You can be assured if I see any of our supply and demand charts providing insight appreciation is coming I will be sure to provide that information in this blog.

Happy hunting…

Meet Larry Chatt. Larry is the Broker/Owner of Island Real Estate – and has owned Anna Maria Island investment property while residing in New England, Ohio, Colorado, Iowa and across Europe. He and his family have been on the island for decades and Larry has served his community in various roles with the Anna Maria Island Chamber of Commerce